Note to pensioners: is it worth joining a non-state pension fund? Is it worth switching to a non-state pension fund?

Since 2002, a law came into force that radically changed the entire pension system in the country. Citizens must receive support from funds that the employer contributed to the Pension Fund of the Russian Federation throughout their entire working career (No. 173-FZ of December 17, 2001). From the moment of the reform to the present day, amendments have been systematically made to the law.

Contribution structure for future old age benefits

Today, the provision is formed from mandatory contributions paid by the employer as a percentage of wages, as well as voluntary contributions from citizens to the account of their future pension.

The employer is obliged to transfer 22% of wages to the Pension Fund on a monthly basis.

These funds are distributed as follows:

- 16% goes to the insurance pension account.

It is formed according to the insurance principle, and is payable when grounds for retirement arise. The insurance share is formed only from funds paid by the employer.

- 6% – funded part.

A citizen has the right to dispose of savings funds at his own discretion within the framework of the law, and it can also be increased through additional contributions.

Since 2014, a moratorium has been introduced on the formation of pension savings in the Pension Fund of Russia, premiums are automatically transferred to insurance. A citizen has the right to transfer savings to a non-state pension fund.

Reference. If a person has not entered into an appropriate agreement with a non-state pension fund, all money is accumulated in accounts in the pension fund and is subject to annual indexation by the state by the percentage of inflation.

Cumulative part of pension

It is savings contributions that are of greatest interest to citizens. The savings part represents savings in a person’s separate account.

Its value will be an increase to the pension upon reaching the right to it.

Until 2014, these funds were generated in the accounts of the Pension Fund.

After changes are made to the legislation (Federal Law on funded pensions, Article 18), savings are automatically transferred to the insurance share account, however, a person has the right to send this amount to a non-state pension fund.

Article 18. Entry into force of this Federal Law

- This Federal Law comes into force on January 1, 2015.

- The funded parts of old-age labor pensions established for citizens before January 1, 2015 in accordance with the legislation of the Russian Federation in force before the entry into force of this Federal Law are considered funded pensions from that date.

- Non-state pension funds, before April 1, 2015, notify insured persons of the corresponding change in the name of payment from pension savings provided for in contracts on compulsory pension insurance.

Which are concluded between non-state pension funds and insured persons before the entry into force of this Federal Law, by posting information about this change on the website of the non-state pension fund on the Internet and (or) publishing it in the media.

A person can independently increase savings by additionally transferring money to the appropriate account. The funded part can be inherited. This can be very beneficial for the future of a particular person.

Is it necessary to transfer it to a non-state pension fund and why should this be done?

Here we will tell you in more detail whether it is necessary to transfer contributions to a non-state pension fund and why this should be done? Since 2014, the so-called non-state pension funds have received the right to manage savings (Law No. 410-FZ of December 28, 2013). These are organizations that manage savings funds without access to the personal accounts of their owners. Non-state pension funds can invest money in securities, various projects to receive income, etc.

Such institutions are interested in the money generating income, since they receive their commission from the profits received and some bonuses from the state.

Thus, the income of a non-state pension fund directly depends on the growth of savings in the accounts of its depositors.

The law does not oblige citizens to transfer their pensions to such funds.

The law does not oblige citizens to transfer their pensions to such funds.

However, NPF has a number of advantages over a government institution:

According to the law, a citizen has the right to independently manage his funded pension. At the same time, the citizen has a question: leave the accumulated funds in the Pension Fund or transfer them to a Non-State Fund (NPF). Such (non-state) funds preserve the savings of working citizens at a higher percentage than the usual Pension Fund. Consequently, many insured persons have doubts about choosing a fund. Today we will determine whether it is worth transferring savings to a non-state pension fund.

Is it worth switching to a non-state pension fund?

Every working citizen has the right to independently make a choice in favor of one of the non-state pension funds. At the same time, there are no articles in the legislation that force citizens to transfer savings to one of the many funds. Therefore, the transfer of pension funds to a non-state pension fund is a voluntary desire of a citizen.

Well, now let’s find out whether it’s worth transferring the funded part (hereinafter referred to as PF) to the NPF. Such non-state pension funds were formed to increase the pension savings of citizens. Consequently, such companies operate under the control of government agencies, and the insured person will not be able to lose savings when transferring NP.

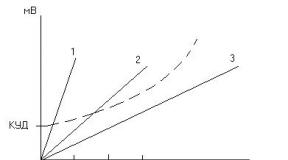

The main reason for the development of non-state pension funds is the low profitability of the Pension Fund (no more than 6%). At the same time, the inflation rate may exceed these indicators. As a result, the amount of savings depreciates every year.

When transferring NPs to NPFs, NPs contribute to more profitable areas. Thus, LF remains and increases annually. However, NPFs cannot guarantee a consistently high percentage of investment activities.

In addition, in most cases, NPFs are created by large companies such as Sberbank, Lukoil, Gazprom, and so on. Consequently, such companies have an excellent reputation and a high level of security.

Another important point is that if a non-state pension fund disappears from the market, then pension payments are automatically returned to the Pension Fund. As a result, citizens cannot lose their own NP.

Thus, transferring savings to a non-state pension fund is a profitable and safe event. This option is perfect for those who are thinking about future well-being and strive to preserve their income.

How to switch to NPF?

To transfer to a non-state pension fund, a citizen must do the following:

- Select NPF – read about how to analyze NPF in one of the following chapters.

- Contact the NPF - you can submit an application either in person or online on the fund’s website.

When applying in person, the client signs a compulsory pension insurance (compulsory pension insurance) agreement at the NPF branch. You need to have your passport details and SNILS with you.

When applying online, the client fills out a special online form to transfer to a non-state pension fund. Within a few days, a representative of the fund contacts the potential client to conclude an agreement.

Another way is to mail two copies of the agreement (can be found on the website of the selected fund) to the address of the fund’s main office. The letter should include a copy of your passport data and SNILS.

- Visit to the Pension Fund - after signing the agreement, the citizen must submit an application to the Pension Fund to transfer to a particular fund. The citizen must take with him standard documents - passport, SNILS. When visiting a NPF in person, this function (transferring the application to the Pension Fund) is performed by NPF employees.

Then the Pension Fund employees send the citizen a written notification of the decision made.

Since 2014, the insurance policy has been frozen until 2019. Consequently, in 2017, current employer contributions are received only for the insurance part.

Why is it worth switching?

When transferring a private fund to a non-state pension fund, a citizen receives additional benefits, such as:

- higher percentage of investment activity;

- indication of heirs when signing the OPS agreement;

- financial liability on the part of NPFs for the deposits of insured persons;

- when the license is revoked, the NP is returned to the Pension Fund;

- the ability to terminate the contract at any time (but preferably no earlier than 5 years);

- protection against inflation;

- high level of service;

- online access to the amount of savings;

- openness – the fund is obliged to publish annual reports in the public domain.

Which fund is better?

When choosing a non-state pension fund, you should pay attention to such points as:

- Profitability for the entire period of work.

- Availability of the “Personal Account” service.

- Work period.

- Availability of a license.

- Reliability level.

- Volume of funds.

- Composition of founders – you should not trust small funds and individuals.

- Openness and accessibility of information.

- Positive customer feedback.

- Availability of convenient service (hotline, office near home).

When choosing a non-state pension fund, it is worth considering several indicators, not just profitability.

Over the past 4 years, citizens have given preference to such funds as:

- Lukoil - Guarantor.

- Sberbank.

- Gazfond.

Transfer to NPF Sberbank

Since 2009, Sberbank has been carrying out activities to protect the pension savings of insured persons. The rating agency assigns this NPF an A+ rating (National Rating Agency - AAA). The main advantage of this NPF is the huge number of branches throughout the country.

To transfer to NPF Sberbank, a citizen must apply to any bank branch with a passport and SNILS (green card). At the bank, the client fills out a special form for transferring the NP to Sberbank. The whole procedure takes no more than 20 minutes.

After this, the citizen must submit an application to the Pension Fund for the transfer of funds to NPF Sberbank.

In the future, the client will be able to monitor the movement of low frequencies through his Sberbank personal account. Thus, in the online account, a citizen will have access to the following information: amount of NP; payment accrual date; income for the previous period.

Video: how to switch to NPF

In conclusion, it is worth recalling that every citizen has the right to independently choose one or another fund for the safety of pension savings. At the same time, it is important to take into account the peculiarities of the work of non-state pension funds, which are discussed in more detail in this material.

The funded part of the pension is a money supply that is managed by professional market participants in the interests of the insured person (in this case, a pensioner). The funded part of the pension is formed exclusively in financial terms, no points or other systems are used here.

The receipt of funds to the owner's account is carried out through the turnover of the above-mentioned financial instruments by professional market players. If we draw an analogy, the actions of these managers can be compared with the activities of the banking system - taking money from citizens for safekeeping and putting it into circulation to accrue interest on deposits.

In the finished version, this looks like an amount that is constantly in the account of a future or already retired citizen, and the work of managers and income from cash turnover is preserved as long as the given citizen is alive.

Regarding the indexation of pensions, you should immediately be prepared for the fact that government announcements about raising pension payments will not affect the owner of the savings account. On the one hand, this may seem like a minus. On the other hand, competent managers and a deposit insurance system are capable of generating more income than the state could do.

IMPORTANT! The advantage of the funded part of the pension over the insurance part is that the accumulated funds can be withdrawn immediately upon reaching retirement age, before reaching this age, and also transferred as an inheritance.

A non-state pension fund is an organization that has the right to manage finances on behalf of the owner of the pension fund. This is the same professional market participant mentioned above.

Is it necessary to transfer to a non-state pension fund?

This is a rather subjective question and must be answered based on the wants and needs of the account holder. As such, there is no obligation to transfer the funded part of the pension to a non-state pension fund. And if you do not take care of your future savings on your own, the state will take this issue upon itself and transfer all available funds to a controlled organization, where the capitalization from the circulation of money will be somewhat less.

What happens if you don't translate?

If for some reason a citizen has not transferred his funded pension to a non-state pension fund, then this is not a big tragedy. The pension fund will simply direct the funded part of the pension to its own structures(as a rule, Vnesheconombank, a state management company, deals with this).

You should not believe various sources that claim that all money not transferred to the NPF will be burned.

It is enough to contact the Pension Fund of the Russian Federation, where a consultant over the phone will be able to competently explain that these are all fictions that should not be paid attention to. The money of future retirees will not go to waste.

The difference will be tenths of a percent of the turnover. On the other hand, the insured person receives almost completely guaranteed security of preserving his funds, since this GUK can neither go bankrupt nor go bankrupt. The same cannot be said about other market participants.

Is this investment profitable?

Yes, it's profitable. There are quite a large number of non-state pension funds that are in close connection with government agencies. The difference, as before, lies only in the conditions for calculating the bonus part of the funded pension. Somewhere it will be a little more, somewhere a little less.

Yes, it's profitable. There are quite a large number of non-state pension funds that are in close connection with government agencies. The difference, as before, lies only in the conditions for calculating the bonus part of the funded pension. Somewhere it will be a little more, somewhere a little less.

Besides, You can manage the funded part of your pension yourself, and if at the time of the policyholder’s death there is money in the account, then his relatives will be able to easily receive these funds for their management. This is not possible with an insurance pension.

In addition, it is not only profitable, but also safe. All relations between the state, non-state pension funds and clients are regulated by Federal Law of December 28, 2013 N 424-FZ “On funded pensions”.

If any controversial issues suddenly arise, the judicial authorities are more likely to make a decision that is positive for the client based on the existing regulatory act.

Advantages and disadvantages

Benefits of NPF:

- It is possible to directly influence the amount of future payments.

- It is possible to receive income from several sources at once.

- Future retirement is easier to predict.

- Pension contributions are tax-free, so nothing is lost.

- All NPFs are carefully controlled by special government bodies.

- Management companies (NPFs) can invest exclusively in assets that have proven their reliability and only in Russia.

- There is always the possibility of transferring funds from one non-state pension fund to another.

Disadvantages of NPF:

- The future is quite vague. Even despite all the positive assurances from politicians and economists, depositing money into a non-state pension fund will be considered a long-term investment. In addition, experts predict that the key players in this market will shrink by about half. The money must be brought now, but there is no guarantee that it will be paid as promised.

- Fraud. Many dubious companies often cover up their illegal activities with the guise of a pension fund, but in reality it turns out that they simply appropriate all the financial resources received from the population and hide, as a rule, abroad. In order to protect yourself from scammers, you need to carefully select an organization, check its details through government portals, and not pay attention to the unrealistically high percentage of promised profits.

Today, due to the difficult economic situation in the country, most middle-aged people no longer have any special hopes for doing what they can to provide them with a decent old age.

It is in pursuit of social guarantees that many Russians transfer their savings to NPFs - non-state Pension Funds. What kind of structure is this? What bonuses and, most importantly, risks exist when transferring your savings to a non-state Pension Fund? Let's try to figure it out.

Most pensioners are distrustful of non-state pension funds

Non-state Pension Funds are organizations that manage the funded portions of the pensions of citizens who apply to them, namely, those that invest the proceeds in state corporations, securities or bank deposits and thus increase the savings of their investors.

As a rule, NPFs can offer everyone interested in their services more favorable interest rates on deposits. It is not surprising that many see in non-state funds, first of all, an opportunity to become richer through the right investments and, as a result, to ensure a more dignified old age. But is it safe to invest in non-state pension funds?

Absolutely safe! From a legal point of view, the non-state Pension Fund is an absolutely legal structure under the direct control of the government. For an ordinary citizen, this state of affairs is a 100% guarantee of the safety of cash savings in the event of their transfer to a non-state pension fund.

Even if for some reason the company itself is liquidated, all funds in its accounts will be preserved thanks to insurance and will then simply be transferred back to the state Pension Fund.

Is it worth switching to a non-state Pension Fund?

Whether to join a non-state pension fund or not is a difficult question

In order to confidently answer the question of whether it is worth transferring your savings to a non-state pension fund, you need to figure out exactly how social payments due to citizens after ?

As you know, when officially employed, a certain part of the employee’s monthly salary is automatically transferred to the Pension Fund. It is these regularly deducted amounts that form pension savings.

All funds received in this way are divided into three parts. These are the basic, insurance and funded parts of the pension. For the first two parts, the rate on social payments for members of state and non-state Pension Funds is identical (6% and 14%, respectively).

However, when it comes to the latter, the situation changes radically. As a rule, NPFs offer a 6% rate on this payment, versus 2% in the State Pension Fund, which naturally attracts potential investors.

Of course, there are other arguments in favor of transferring to non-state Pension funds:

- Non-state pension funds form the funded part of pensions not only from deductions from the wages of investors, but also by investing funds. Consequently, by making the transition to a non-state Pension Fund, in the future you can get much greater “profit”.

- A special insurance program, valid for all non-state pension funds, allows investors not to be afraid of possible "" and, as a result, hungry old age in the event of unsuccessful investments of their money. All funds lost in this way are compensated to pensioners from the organization’s own reserves.

- The investment plans of any non-state pension fund are constantly adjusted in accordance with the current situation in the economic market. This means that the probability of losing expected income as a result of improper investment of pension savings for each individual investor tends to zero

Are there any risks when switching to a non-state pension fund?

Joining a non-state pension fund carries small risks, but they exist...

Compared to the obvious benefits of transferring to a non-state Pension Fund, the risks that may be encountered during or after this procedure appear minimal. However, one cannot fail to mention them.

Due to the fact that the world economy is developing extremely unpredictably, when joining a non-state pension fund it is impossible to be absolutely sure of the specific amount of profit on pension savings even for the current calendar year. Simply put, by turning to a non-state fund, a future pensioner loses confidence in the stability of his income.

Since joining a non-state pension fund is a purely voluntary matter, a potential investor will have to independently analyze all the offers presented on this market and personally choose the legal structure that offers the most suitable deposit conditions for him.

In the event that a future pensioner for some reason decides to change one non-state fund to another (we are talking about any situations, including, for example, those when the license of the organization currently serving him was revoked), all costs for this procedure will fall on him shoulders.

Summarizing all of the above, we can come to the following conclusion: the transfer of pension savings to non-state funds in itself is a fairly profitable enterprise, which, however, is not without a certain degree of risk. This option is ideal for those who are concerned about their future well-being and want to save more money for a dignified retirement with minimal effort.

For those who are accustomed to personally managing their savings, independent investing in securities and (or other methods of investing pension capital, of which there are quite a few today), will be more attractive. In short, each potential investor has the right to resolve this issue individually according to his personal beliefs.

How can you legally register a transfer to a non-state pension fund?

It is difficult for pensioners to understand all the intricacies of the pension system on their own.

As practice shows, many future pensioners are held back from switching to non-state pension funds by the banal fear of getting involved in unnecessary bureaucratic procedures. However, in reality, changing a pension fund is not as difficult as it might seem at first. In order to transfer to a pre-selected non-state pension fund, it will be enough to write a simple application.

However, let's not get ahead of ourselves. Let's consider how the process of transition from a state Pension Fund to a non-state one occurs, step by step:

The last item on the list is worth dwelling on in a little more detail. Many citizens are interested in the question: how and where can they submit the necessary documents to the State Pension Fund? Do you have to do this in person?

In fact, in addition to personally appearing at the Pension Fund office (in this case, you will need to have a Russian passport with you, as well), you can also send an application through the MFC system or even by mail. In the latter case, the future pensioner will have to use a special service called sending registered letters with attachments and notification.

In order not to have to worry about the safety of the documents attached to the application, at any of the mentioned institutions you can ask an employee about their receipt. If the papers are sent by mail, instead of the original passport and SNILS, it is allowed to put photocopies of them in the envelope.

This is important to know: a citizen’s transfer to a non-state pension fund can be considered officially realized only after the future pensioner receives the corresponding one from the state Pension Fund.

State or non-state pension fund? This video will help you make your choice:

Constant economic instability is exactly what frightens many Russian citizens from trusting money to the state. Trying to give themselves at least some social guarantees regarding a future pension, residents of our country increasingly began to transfer their own savings to non-state Pension funds.

However, what are these structures? What bonuses do they offer? Are there any risks in working with them? Is it necessary to transfer to a non-state Pension Fund in today's realities? Let's figure it out.

The non-state pension fund seems unreliable for many pensioners

A non-state Pension Fund (NPF) is an organization that receives savings from citizens and, through some manipulations, increases them, after which it issues funds to investors in the form. If you delve deeper into the investment process, it is extremely simple and looks like this:

- The NPF forms an “army” of investors, receiving the nth amount of money from them.

- Invests the received values in securities or bank deposits, and also retains part of the funds received from the citizen in the form of the basic part of the pension.

- It multiplies investments and later issues them to investors in the form of a full pension.

Organizations such as NPFs are commercial entities, so they can offer their clients more favorable interest rates on deposits than the state itself. This is largely due to the fact that non-state Pension funds do not have much dependence on the current economic situation, since they invest funds in the most reliable financial projects.

It is important to understand that investing your savings in the NPF budget is not dangerous. From the point of view of legislation, these organizations are legal structures, the activities of which are clearly regulated and controlled at the state level.

Moreover, a number of legislative acts confirm that anyone has the right to transfer their pension savings from the balance sheet of a state pension fund to the balance sheet of a non-state pension fund and vice versa.

If the NPF is liquidated or disbanded, the amount of transferred funds is returned to the citizen’s account in the state Pension Fund, that is, the investor does not lose anything. This opportunity appeared not so long ago and is based on the fact that the state obliges any non-state pension fund to insure the deposits received, otherwise its activities will be impossible.

Does it make sense to switch to a non-state pension fund?

Not all pensioners want to transfer to a non-state pension fund

Every citizen of the Russian Federation must answer the question about whether it is necessary to transfer to a non-state pension fund. To do this, it is enough for him to have an idea of how it is formed in our country. Today the order of its formation is as follows:

- A citizen provides a certain amount of funds to the Pension Fund (in case of official employment, part of the employee is transferred to the Pension Fund on a monthly basis).

- The funds received are divided by the organization into three categories: basic, insurance and savings.

- After this, each part of the future pension is compared with the corresponding rate and accumulation occurs.

In state and non-state pension funds, completely identical rates apply for the basic and insurance parts of pensions - 6 and 14%, respectively. But for the savings category of funds, NPFs have a noticeably higher interest rate and amount to as much as 6%, versus 2% for government agencies.

That is, with the proper selection of a non-state pension fund, any citizen of Russia will be able to significantly increase their pension savings over the same period of time that they would cooperate with a government structure. In addition, there are other advantages in cooperation with NPFs, among which it is worth highlighting:

- Supplement to pension in the form of investments that non-state entities invest in state corporations, securities and bank deposits. The State Pension Fund does not deal with such things. In addition, any reputable non-state pension fund competently monitors the situation on the economic market, so unprofitable or risky investments of investors’ money are practically excluded.

- Full deposit insurance, which eliminates the loss of depositors' funds.

Are you interested in such prospects? Decide for yourself. We can definitely say that non-state Pension funds deserve the attention of every citizen of the Russian Federation who intends to receive a solid pension in old age.

Transition order

It’s not difficult to switch to a non-state pension fund

The procedure for transferring from a state PF to a non-state PF does not present any particular difficulties. Many people mistakenly believe that to implement it they will have to get involved in all the bureaucratic litigation, but this is definitely not the case. In order to switch to a non-state pension fund, it is enough:

- Find a reliable non-state Pension Fund. It is important to base this on two indicators:

the duration of the organization’s work on the market (the longer it is, the better);

feedback on the structure (the better they are, the more preferable the PF is for cooperation). - When choosing a non-state pension fund, it is better to sacrifice a couple of savings interest rather than enter into a contract with an unscrupulous organization.

Found the fund? Now you need to contact it, talk to the staff and, if everything is in order, conclude a compulsory pension insurance agreement. Before signing the paper, do not forget to study the contents of the agreement in detail to make sure that all its provisions suit you. If this is not the case, then it is better to refrain from cooperation with the PF.

After concluding an agreement with a non-state pension fund, all that remains is to notify the state pension fund about this by submitting a special application to its department. A sample of this is usually provided to the NPF.

Please note that when notifying a government agency about the transfer to the balance sheet of a non-state PF, it is also important to have with you a passport of a citizen of the Russian Federation and a personal one. Having submitted the relevant documents, it is advisable to take a corresponding receipt from the fund employee so that no problems arise in the future. This completes the transition procedure. As you can see, there are really no special difficulties in it.

Risks of cooperation with an organization

Most pensioners are distrustful of non-state pension funds

At the end of today’s article, let’s say a few words about the risks that accompany cooperation with non-state pension funds. As it became clear from the material presented above, there are few of them, but they still exist, so ignoring their consideration is simply unacceptable.

Let us immediately agree that when cooperating with a bona fide non-state pension fund, all risks can be neglected, because they are extremely small. However, when choosing a structure with a dubious reputation, it is worth taking into account any potential danger.

It was previously noted that the loss of funds invested in NPFs is impossible, since all deposits are insured. However, it is quite possible to lose benefits from the funded part of your pension. The risks are especially great if:

- the headquarters of the NPF employs incompetent economists who cannot qualitatively analyze the economic situation in the country and often make mistakes when investing depositors’ funds;

- the country's economy will spontaneously collapse.

Of course, no one can be insured against the first case, but protection against the second is simple to the point of disgrace - you just need to choose a solid fund for cooperation.

Perhaps this is where the most important provisions on today's issue have come to an end. We hope that the material presented above was useful to you and provided answers to your questions. Good luck in investing your savings!

This video will tell you how a non-state pension fund works: