List of participants of consolidated groups of taxpayers. Consolidated Group of Taxpayers (CGT). Main signs of CGN

of this Code, unite on a voluntary basis without creating a legal entity for the purpose of calculating and paying corporate income tax for a consolidated group of taxpayers in the manner and under the conditions established by this Code.

2. An agreement on the creation of a consolidated group of taxpayers must contain the following provisions:

1) the subject of the agreement on the creation of a consolidated group of taxpayers;

2) list and details of organizations - participants of the consolidated group of taxpayers;

3) the name of the organization - the responsible participant in the consolidated group of taxpayers;

4) a list of powers that the participants of the consolidated group of taxpayers transfer to the responsible participant of this group in accordance with this chapter;

5) the procedure and timing for the performance of duties and the exercise of rights by the responsible participant and other participants in the consolidated group of taxpayers not provided for by this Code, liability for failure to fulfill established obligations;

6) the period, calculated in calendar years, for which a consolidated group of taxpayers is created, if it is created for a specific period, or an indication that there is no specific period for which this group is created;

7) indicators necessary to determine the tax base and payment of corporate income tax for each participant in the consolidated group of taxpayers, taking into account the specifics provided for in Article 288 of this Code. In this case, the selected indicators are not subject to change during the entire validity period of the agreement on the creation of a consolidated group of taxpayers.

3. To legal relations based on an agreement on the creation of a consolidated group of taxpayers, the legislation on taxes and fees is applied, and in the part not regulated by the legislation on taxes and fees - civil legislation Russian Federation.

Any provisions of an agreement on the creation of a consolidated group of taxpayers (including such an agreement itself), if they do not comply with the legislation of the Russian Federation, may be declared invalid in court by a participant in this group or a tax authority.

4. The agreement on the creation of a consolidated group of taxpayers is valid until the earliest of the following dates:

1) the date of termination of the said agreement, provided for by this agreement and (or) this Code;

2) dates of termination of the contract;

3) the 1st day of the tax period for corporate income tax following the date of refusal by the tax authority to register the specified agreement.

ConsultantPlus: note.

Since 09/03/2018, agreements on the creation of corporate groups are not registered. Agreements registered in 2018 before 09/03/2018 are considered unregistered. Previously registered contracts are valid until the expiration date of their validity, but no later than 01/01/2023 (Federal Law dated 08/03/2018 N 302-FZ).

5. An agreement on the creation of a consolidated group of taxpayers is subject to registration with the tax authority at the location of the organization - the responsible participant in the consolidated group of taxpayers.

If the responsible participant of a consolidated group of taxpayers, in accordance with Article 83 of this Code, is classified as the largest taxpayer, the agreement on the creation of a consolidated group of taxpayers is subject to registration with the tax authority at the place of registration of the specified responsible participant of the consolidated group as the largest taxpayer.

6. To register an agreement on the creation of a consolidated group of taxpayers, the responsible participant in this group submits the following documents to the tax authority:

1) an application for registration of an agreement on the creation of a consolidated group of taxpayers, signed by authorized persons of all participants of the consolidated group being created;

2) two copies of the agreement on the creation of a consolidated group of taxpayers;

3) documents confirming the fulfillment of the conditions provided for in paragraphs 2 and 5 of Article 25.2 of this Code, certified by the responsible participant of the consolidated group of taxpayers, including copies of payment orders for payment of value added tax, excise taxes, corporate income tax and mineral extraction tax minerals (copies of decisions of the tax authority to offset the taxes listed above), balance sheets, financial statements for the previous calendar year for each of the group members;

(see text in the previous edition)

4) documents confirming the powers of the persons who signed the agreement on the creation of a consolidated group of taxpayers.

7. The documents specified in paragraph 6 of this article are submitted to the tax authority no later than October 30 of the year preceding the tax period from which the corporate income tax is calculated and paid for the consolidated group of taxpayers.

8. The head (deputy head) of the tax authority, within one month from the date of submission to the tax authority of the documents specified in paragraph 6 of this article, registers the agreement on the creation of a consolidated group of taxpayers or makes a reasoned decision to refuse its registration.

If violations are detected that can be eliminated within the period established by this paragraph, the tax authority is obliged to notify the responsible participant in the consolidated group of taxpayers about them.

Before the expiration of the period established by this paragraph, the responsible participant in the consolidated group of taxpayers has the right to eliminate the identified violations.

9. Subject to the conditions provided for in Article 25.2 of this Code and paragraphs 1 of this article, the tax authority is obliged to register an agreement on the creation of a consolidated group of taxpayers and, within five days from the date of its registration, issue one copy of this agreement with a mark of its registration to the responsible participant of the consolidated group. groups of taxpayers in person against receipt or in another way indicating the date of receipt.

Within five days from the date of registration of the agreement on the creation of a consolidated group of taxpayers, information on the registration of the agreement on the creation of a consolidated group of taxpayers is sent by the tax authority to the tax authorities at the location of the organizations - participants of the consolidated group of taxpayers, as well as at the location of separate divisions of the organizations - participants of the consolidated group taxpayers.

10. A consolidated group of taxpayers is recognized as created from the 1st day of the tax period for corporate income tax following the calendar year in which the tax authority registered the agreement on the creation of this group.

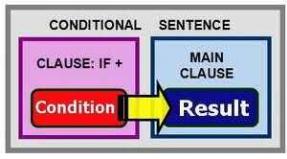

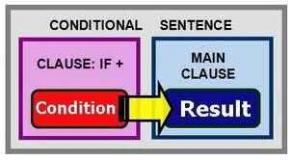

Concept of contract

In tax law, there is the concept of a consolidated group of taxpayers, which is an association of payers on a voluntary basis. They are united by the total aggregate income of organizations, on which the general tax is paid.

An association is created on the basis of a legally drawn up and signed agreement on the creation of a consolidated group of taxpayers.

According to latest changes In tax legislation, those agreements on the creation of a consolidated group of taxpayers drawn up and signed before 2016 are considered unregistered. From 2016 and throughout 2017, such agreements do not have to be registered with the Tax Service. This aspect was spelled out in Federal Law No. 325 in Article 3.

The agreement is a document according to which organizations that have direct relation to each other’s activities, pay tax on their total income to the state budget.

The agreement is purely voluntary and does not oblige organizations to form a single legal entity. An agreement is drawn up only when organizations qualify and meet all the conditions set forth by tax legislation.

Provisions specified in contracts

The agreement on the creation of a consolidated group of taxpayers, subject to tax and civil law, there can be no discrepancies or contradictions with them. There is a separate part in the Tax Code for contracts of these types. The main provisions are stated in Chapter 3.1. In particular, in Article 25.3.

The provisions of the agreement include such aspects as:

- the period for which the group of payers was created, if any (provides for the possibility of creating an open-ended agreement, which can be terminated at the mutual request of the parties);

- procedures and powers of all group members (provided that they go beyond what is prescribed in the Tax Code, but do not contradict it);

- the deadline for fulfilling obligations on the part of each of the parties to the contract;

- the name (should be understood as a legal official) of the group, where the name of the responsible member of the group is taken as a basis;

- a complete list indicating all the details of each participant;

- subject of the contract;

- indicators on the basis of which the tax base and the amount of tax are calculated, which cannot be changed during the entire validity period of the drawn up and signed agreement.

An agreement on the creation of a consolidated group of taxpayers within the framework of tax law cannot have any aspects that could contradict the law.

Otherwise, in court, any member of the group, as well as the controlling tax authority, this agreement may be declared invalid and illegal. Which in turn does not entail liability on the part of those who compiled it.

It is simply recognized as invalid, having no force, and therefore not allowing organizations to pay one tax on the total profit.

Validity period and terms of the contract

An agreement on the creation of a corporate group is created by organizations that, in the course of their activities, may have a combined income, but at the same time are not a single legal entity.

According to Article 25.2 of the Tax Code, one or more organizations can and do participate in creating capital for other organizations. It doesn’t matter how exactly - directly, by investing, or indirectly. Each share of the created group attributable to a particular organization is determined by the norms of the Tax Code.

An agreement on the creation of a consolidated group of taxpayers has a certain validity period, even if it is not specified in the agreement itself. However, this is precisely what causes some controversy among legal scholars.

Thus, according to Article 25.3 of the Tax Code, the agreement falls under the department of tax law, but all unexplained aspects fall under the department of civil law. According to the norms of the latter, an open-ended contract implies termination at the request of one of the parties or mutual desire.

The Tax Code provides for three types of contract validity periods, after which it is considered to have expired. These periods include:

- expiration of the prescribed validity period;

- moment of termination;

- the beginning of a new tax period, which begins on the first day of the new period, after the tax authority refused to register the agreement.

That is, if the contract does not specify a period, and the tax authority does not register the contract, then it loses its force from the moment the refusal is received. Russian legal scholars agree that there are not many grounds for refusing registration. And tax legislation even provides for a deadline for making appropriate changes so that the agreement can be signed by the tax authority.

Thus, a period of one calendar month is provided during which the agreement is reviewed by the head of the tax authority. If changes cannot be made during this period, the contract from consideration is transferred back to the responsible participant with an explanation of the refusal.

The agreement is submitted for consideration no later than October 30 of the year in which it was drawn up, and if the tax authority makes an affirmative decision for registration, it comes into force from the new calendar year (with the beginning of the new tax period). All contracts and documents submitted later are not subject to consideration.

Document submission procedure

In order for the agreement to be registered with the tax authority, the responsible group member submits a complete package of documents for consideration, which includes:

- agreement (2 copies, each of which is personally signed by authorized persons);

- documents approving and defining the powers of each organization of the payer group;

- an application for registration, which is signed by all members of the group (should be understood as authorized persons from each of the participating organizations) or their representatives;

- proof documents confirming that all conditions were met by the organizations for the creation of the group.

In cases where the head or his legal representative of the tax authority has discovered violations under the current tax legislation, he notifies the responsible participant by sending him a corresponding notice. If in statutory changes cannot be made within the deadline, the manager issues a refusal indicating the reasons.

If the agreement and the package of documents do not raise any doubts about the legality and authenticity, then the manager registers the agreement. Within the period established by law, one signed copy with a registration mark is transferred to the responsible member of the entire group.

Exactly five calendar days are provided for this action. A copy is handed over either in person (should be understood as handing over against the signature of the responsible person) or in any other way with notification of receipt.

The registering tax authority transmits to other tax authorities, which include participating companies, all information about the registration of a corporate group agreement within the prescribed period, which by law is exactly five days. The calculation is carried out in calendar form. All documents for registration are submitted at the location of the participating organization that is recognized as responsible for the entire group of organizations.

In cases where participating organizations feel that their rights have been violated and the refusal was issued without justification, they have the right to apply to the court to review the legality of the actions of the head of the tax authority. All circumstances are considered in court, including each clause of the agreement on the creation of the Group of Companies.

In cases where no violations are found on the part of the court, the agreement is subject to registration even when the deadline for submitting documents has already been missed (should be understood as dates after October 30 current year and tax period).

The head of the tax authority may incur disciplinary, criminal or administrative liability for violating and exceeding his powers.

The only grounds for refusal can be those specified in Article 25.3 of the Tax Code. These include:

- failure to comply with the conditions under which a consolidated group can be created;

- illegality of the clauses of the drawn up contract;

- Missing the deadline for submitting documents and contracts;

- not providing documents in full for consideration;

- an illegally signed agreement (should be understood as signed by those persons who were not authorized to do so by the organizations).

The refusal is transmitted to the responsible participant, who is obliged to independently distribute copies to the participating organizations. The refusal, as well as a signed copy with a registration mark, is transferred against the signature of the responsible participant or in any way where it is possible to track the date of receipt. For example, by sending by registered mail.

Consolidated group of taxpayers- a voluntary association of corporate income tax payers on the basis of an agreement on the creation of a consolidated group of taxpayers in the manner and under the conditions provided for by the Tax Code of the Russian Federation, for the purpose of calculating and paying corporate income tax, taking into account the total financial result of the economic activities of these taxpayers (clause 1 of Art. . 25.1 NK)

Maintaining the institution of a consolidated group of taxpayers.

The concept of tax consolidation in a group of companies has long been discussed by specialists and government officials, so the novelties were expected by the business community. Consolidation of taxation of holding participants when paying income tax corresponds to the practice of most foreign countries and the law of the European Union. The consolidated taxes, the grounds for consolidation, including the perimeter of consolidation, the mechanism of consolidation and tax payment may differ, but the principle itself, that group members are treated as one economic unit, is basic for the legislation of most countries.

Summarizing foreign practice, D. Vinnitsky identifies two significantly different models of consolidated taxation of holdings. “According to the first, consolidation is carried out by “incrementing” the tax legal personality of the parent (management) company, i.e. the parent organization gets the opportunity to take into account the financial result of the activities of subsidiaries when calculating and paying a number of taxes. To put it simply, in this case, for the purpose of calculating certain taxes, subsidiaries companies are equal in their own way legal status to branches of the legal entity - the parent company. In accordance with the second model, for tax purposes, the entire corporate association (holding) is recognized as having legal personality from the point of view of tax law, which, in relation to a number of taxes, acts as a single taxpayer, providing centralized tax accounting for the corresponding tax payments. Theoretically, the burden of fulfilling the obligations of a consolidated taxpayer can be assigned to any company that is part of a given corporate association (holding)."

Based on the analysis of the Law “On a Consolidated Group of Taxpayers”, the consolidation of taxation of the profits of group members proposed in it does not change the basic principles of taxation established by Russian legislation and does not provide for the creation of a new subject of taxation in the form of a consolidated group. At the same time, holding participants are considered as a consolidated group of taxpayers (hereinafter referred to as CTG), which are not just a set of independent organizations, but a kind of economic unity, within the framework of which consolidated tax accounting is maintained (objects, deductions, income, expenses) and a consolidated consolidated tax base is formed with the imposition of the obligation to pay tax on one of the group members and joint liability (for payment of tax, penalties, fines) of all members of the group.

The right to consolidated taxation established by the Law - addition of income and losses, offset of intra-company turnover, transfer of income and products between parent and subsidiary business companies - should be considered as a preference for groups of companies. The application of the consolidated income tax calculation regime will also relieve taxpayers from the control of tax authorities over transfer pricing between interdependent parties performing controlled transactions. A visible disadvantage of profit tax consolidation for entrepreneurs is the possibility of bringing members of a consolidated group of taxpayers to joint liability for paying profit tax for other participants. According to paragraph 7 of Art. 46 of the Tax Code of the Russian Federation in the new edition in relation to the corporate income tax under the consolidated group tax, the tax authority has the right to collect tax at the expense of other property of one or more participants in this group if there is insufficient or no funds in the bank accounts of all participants of the specified consolidated group of taxpayers or in the absence of information about their accounts. It is also important to note that the transition to the consolidation of profit taxation is voluntary, so each group of companies has the right to independently weigh the pros and cons of the new tax regime and make the most appropriate decision for itself.

Federal Law No. 321-FZ dated November 16, 2011 amended the Tax Code of the Russian Federation by adding a new chapter 3.1 “Consolidated group of taxpayers”.

Purposes of creating a consolidated group

1) In the case of creating a consolidated group of taxpayers, the consolidated tax base for income tax is subject to determination, which is defined as the arithmetic sum of the income of all participants in this group, reduced by the arithmetic sum of the expenses of all its participants.

At the same time, the negative difference in accordance with Chapter 3.1 of the Tax Code of the Russian Federation recognized as a loss for the consolidated group of taxpayers.

2) Considering that as a result of summing up the received income and expenses of all group members, the resulting result will already take into account the received losses in relation to one or more organizations that are part of the group, then when creating a consolidated group of taxpayers, the amount of income tax subject to payment to the budget.

3) As an additional advantage, it is worth noting that participants in a consolidated group of taxpayers do not submit tax returns to the tax authorities at their place of registration if they do not receive income that is not included in the consolidated tax base of this group. Such income includes income taxed at other rates, or income in the case of withholding and payment of income tax at the source of payment.

4) Tax reporting, as well as tax payment, is carried out for the entire group by the responsible group member, based on the data tax accounting received from the remaining participants in the consolidated group of taxpayers.

Conditions for creating a consolidated group and participating in it

The conditions for creating a group and participating in it are currently quite strict. In this regard, it can be assumed that the creation of consolidated groups of taxpayers will be an isolated phenomenon.

Organizations participating in the CRP must comply "property" criteria- their total indicators for the previous year should be: - 10 billion rubles. - in relation to income tax, VAT, excise taxes, mineral extraction tax (excluding customs duties); - 100 billion rubles. - in relation to sales revenue and other income; - 300 billion rubles. - in relation to assets according to financial statements (clause 5 of Article 25.2 of the Tax Code of the Russian Federation). Certain business entities, in particular residents of free economic zones, banks, pension funds, securities market participants, organizations applying special regimes and in special areas of activity, for example clearing, medical (see more in paragraph 6) cannot be participants in the consolidated group of companies. Article 25.2 of the Tax Code of the Russian Federation). An organization cannot simultaneously be a member of several corporate groups.

To the main restrictions When creating a consolidated group, the following should be included:

a consolidated group can be created by organizations provided that one organization directly and (or) indirectly participates in the authorized (share) capital of other organizations and the share of such participation in each such organization is at least 90 percent ( clause 2 art. 25.2 Tax Code of the Russian Federation);

the total amount of VAT, excise taxes, corporate profit tax and mineral extraction tax for the previous period (excluding VAT amounts associated with the movement of goods across the customs border of the Customs Union) must be at least 10 billion rubles. ( Subclause 1, Clause 5, Article 25.2 of the Tax Code of the Russian Federation);

the total revenue (for all organizations combined) for the previous period should be at least 100 billion rubles. ( Subclause 2, Clause 5, Article 25.2 of the Tax Code of the Russian Federation);

the total value of assets must be at least 300 billion rubles. ( subclause 3 clause 5 art. 25.2 Tax Code of the Russian Federation).

Participants in a consolidated group of taxpayers can only be organizations that pay income tax in the “general manner.” That is cannot be members of a consolidated group of an organization:

applying special tax regimes,

who are residents of special economic zones,

having an income tax exemption.

Banks, insurance organizations, professional participants in the securities market, non-state pension funds can create consolidated groups within the framework of their professional interests. For example, a bank can only be a member of a consolidated group of taxpayers in which all group members are banks.

Enterprises operating on the market bear a certain responsibility to the state. We are talking about taxes. It's no secret that individuals and legal entities must make mandatory payments to the state treasury, in in this case Russian Federation. Of course, the main goal of an organization is to make a profit. The company loses a certain part of its income by fulfilling its obligations in good faith. In addition to the payment itself, it is necessary to maintain quarterly reports, which are subsequently verified by the relevant authorities. In 2012, Russia introduced new law allowing the organization to save some money. Thanks to this act, personal liability for paying tax is reduced, and the amount of deductions is also reduced.

A consolidated group of taxpayers is an association of legal entities on a voluntary basis, the purpose of which is to reduce income taxes. This is exactly what will be discussed in our article.

Concept

In principle, we spoke above about the main purpose of such a formation. Everyone wants to earn more, and by creating such an association, the desired result can be achieved. Moreover, there is no violation of the law, everything is clean and transparent, and the state also has its own benefit. New enterprises will be created, the successful functioning of which will determine the level of the country's economy.

A consolidated group of taxpayers is a small corporation of several companies, within which the income tax is determined using a common tax base. In other words, during the calculation it is necessary to take into account the expenses and income of all enterprises included in the group. Firms' losses are also considered in general terms, and therefore the amount of tax ultimately becomes significantly less than it was for an individual company.

A participant in a consolidated group of taxpayers is a company that is part of the association and meets the necessary criteria. One group can have several participants who pursue the same goal - to earn more money and give less.

Requirements for creating a consolidated group

Of course, everyone wants to save on taxes, but in order to join this association, a number of conditions must be met. The main requirement: the responsible participant in the formation must directly or indirectly manage 90% of the authorized capital of each participant. It is very important that this situation does not change throughout the existence of the association. To accurately determine the share in the authorized capital, it is necessary to carefully study Article 105 of the Tax Code of Russia.

In addition, the following conditions for creating a consolidated group of taxpayers are identified:

- each organization's net assets must exceed its authorized capital;

- the company must receive annual revenue of 100 billion rubles or more (this amount can be achieved through the sale of goods and provision of services);

- the amount of total taxes paid legally should not be less than 10 billion rubles;

- it is necessary that all assets on the balance sheet have a total value equal to 300 billion rubles or more.

It goes without saying that all members of the association should not be at the stages of liquidation, reorganization or bankruptcy. A consolidated group of taxpayers is a formation created for at least two years. In some circumstances, the association may be terminated; we will discuss this in more detail below.

Factors preventing organizations from joining a consolidated group

As with all rules, there are exceptions. Consolidated groups of taxpayers in Russia are being created more and more often. However, not every company can take part in this association. This:

- clearing firms;

- Insurance companies;

- participants of free economic zones;

- consumer cooperatives focused on credit activities;

- organizations that are already members of other consolidated groups;

- microfinance firms;

- medical and educational institutions that use zero percent on profits;

- those who pay taxes on the gambling business.

Many will ask: what about banks and other non-governmental institutions? These organizations can be members of the association only if its other members are similar enterprises.

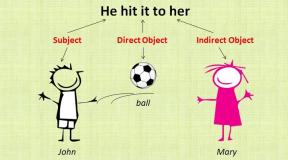

Main member of the group

As already mentioned, in order to create a consolidated association, a responsible participant is needed who will manage 90% of the authorized capital. Let's take a closer look at this legal entity. The responsible participant in the consolidated group of taxpayers is the organization that is considered the initiating party to the agreement on the creation of the formation. It is this enterprise that is obliged to pay general income tax and submit reports to the relevant authority.

However, this legal entity has the same rights and obligations as a regular taxpayer. The fact that a particular company is a responsible participant is proven by a registered agreement on the “birth” of the group. The company must take responsibility when registering the official paper. If the company is also the largest taxpayer, the entire procedure takes place at the tax office where this participant is served.

Agreement of a consolidated group of taxpayers

To document the creation of a consolidated association, it is necessary to register with the tax authority. This should be done by a responsible participant. It is necessary to collect the entire package of official papers. It includes:

- agreement on the creation of a consolidated group (in two copies);

- statement of establishment, which will contain the signatures of all participants in the future consolidated group;

- accounting and financial documents that will confirm the rights of organizations to participate in the formation.

All papers must be signed by the responsible group member. The list of documents must be submitted to the tax authority before October 30, so that starting next year, enterprises operate within the framework of new system taxation. The relevant body makes a decision on the formation of a group within a month.

If minor defects are discovered that can be eliminated within a certain period of time, the tax service gives businesses a chance to correct all errors. If everything is in order, then the association is registered, and within five days one copy of the agreement on the creation of a consolidated group of taxpayers is issued.

After this, additional checks are carried out on the authenticity of the data submitted to the tax service. If no violations are found, then from January 1 of the next year the consolidated group is officially recognized as formed, and from that moment on, the enterprises will operate within the framework of the new taxation system.

Refusal to formalize the contract

After the responsible participant has collected everything Required documents and filed with the relevant authority, the companies are awaiting a decision. This may be approval or refusal. If the answer is no, the tax office usually does not explain the reason. Legal entities must identify it independently and re-apply in the future if desired. In general, the list of reasons for which a refusal was received is closed.

Most often the tax office refuses:

- if one of the participants in the consolidated association does not meet the requirements;

- if the agreement on the creation of a group is drawn up incorrectly;

- if the deadline for submitting an application was missed, violations were found that the responsible participant could not eliminate within a certain time;

- if the contract contains signatures of unauthorized persons.

The refusal of the tax authority does not put an end to the efforts of legal entities; the application can be resubmitted. Sometimes there are situations when companies write a complaint, and it is satisfied. In case of a tax error, tax registration occurs in the same manner, only the application will be accepted.

An association that meets all requirements and is registered on time is recognized as a consolidated group of taxpayers.

Change in contract

In the process of functioning of a consolidated group of taxpayers, it is possible to change the agreement. This occurs when the following cases occur:

- any of the participants is at the stage of liquidation;

- a member of the association intends to reorganize;

- another organization joins the group;

- the participant is going to leave the formation;

- extend the term of the contract.

To make changes to the agreement, it is necessary to create a separate sheet; it will be signed by all organizations of consolidated groups of taxpayers that have recently joined. This paper is also sent to the tax authority for verification.

For changes to be accepted, you must submit to the appropriate service:

- document on the changes made;

- message in two copies with signatures of the participants;

- documents that confirm the powers of the signatories;

- documents confirming the fact that all enterprises meet established requirements.

Changes are processed within ten days, after which the authorized person is given one copy of the registration agreement. This document comes into force from the beginning of next year. If new participants have been added, then the income tax of organizations of consolidated groups of taxpayers will change from January 1.

If other reasons led to the execution of the agreement, then the changes come into force on the established date, but not ahead of schedule registration.

Refusal to register changes

As for the negative decision of the tax authority to register the agreement, here is a list possible reasons. It is worth noting that refusal in this case comes much less often than when drawing up a contract.

So, the main reasons are the following:

- signatures on documents were made by unauthorized persons;

- there are violations in compliance with certain conditions;

- deadlines for submitting documents to the tax service were violated;

- not all official papers were presented.

The taxation of a consolidated group of taxpayers differs significantly from other organizations. Therefore, some enterprises that meet all the necessary requirements are willing to join this association.

Making changes to an agreement is not uncommon, and most companies on the market already know the procedure for submitting an agreement and the review period. Therefore, in principle, there should be no failures, except in cases where the responsible group member made a mistake. The income tax for a consolidated group of taxpayers will be significantly lower than the mandatory payment of each member individually.

Acceptance of a new member into the association and procedure for leaving it

Let's consider accepting a new member into the formation. Since the taxes of the consolidated group of taxpayers differ from other companies, there are more and more applications for admission to the association. The main condition is compliance with all established requirements. In addition, all other group members must agree to be added to their ranks. Only after representatives of all companies have signed can an application be submitted to the tax service. If during the verification it turns out that the organization is not suitable for membership in the group, a refusal will be issued.

If a participant leaves the consolidated association, he or she has certain obligations:

- pay income tax for the period in which the company was no longer considered a member of the group;

- change the tax payment policy from the reporting date;

- submit declarations to the tax authority for periods when the company was not a member of the formation.

Rights and obligations of members of the association

A consolidated group of taxpayers is a voluntary association of organizations that pay income tax. Its main purpose is to pay income tax at a reduced rate.

As in every group, all members of the consolidated formation have their own rights and responsibilities. First, let's talk about the responsible participant in the association. So, the list of his rights includes:

- submission of reports and explanations related to the payment of mandatory payments to the tax authority;

- presence of a consolidated group of taxpayers during an on-site tax audit;

- participation in the consideration of association affairs;

- obtaining information about members of a consolidated formation, which is actually a tax secret;

- appealing the results of on-site inspections.

Regarding responsibilities:

- maintaining reports and declarations with subsequent submission to the tax service;

- filing an application for the creation of a consolidated group, as well as agreements in case of changes;

- if the association ceases to exist, providing complete information on income tax payments;

- in case of failure to fulfill obligations, fines must be paid.

Now let's look at the rights and responsibilities of organizations that are ordinary participants. Among the rights are:

- appealing acts of fiscal officials to higher authorities;

- performing duties voluntarily;

- participation in tax audits in your organization.

Among the responsibilities of a member of a consolidated association, attention is drawn to:

- presentation of all information on income tax paid;

- in case of failure to fulfill obligations - payment of penalties;

- if there is a suspicion of a violation of the terms of the contract, immediately inform the responsible participant about it;

- maintaining your own tax report.

On-site tax audit of a consolidated group of taxpayers

It is worth noting that there is nothing unusual about an on-site tax audit. It is carried out within a certain time frame and in the manner prescribed by the Tax Code. The main documents in this case are reports and declarations provided by the responsible member of the consolidated group. If these papers are not enough, the tax authority submits a request for the need to consider other documents. Only the responsible participant works directly with the commission, and the results of the inspection are also communicated to him.

An on-site audit of a consolidated group of taxpayers has distinctive properties:

- the audit can be carried out both on the territory of the tax authority and in any organization that is a participant in the consolidated association;

- the tax service makes a responsible decision on the audit;

- during an audit, members of the formation may conduct counter-investigations on taxes that are not subject to calculation;

- the inspection can last about two months, in some cases the period is extended to a year;

- additional documents that the commission has asked to provide must be submitted no later than twenty days;

- a report on the results of the inspection is drawn up within three months and handed over to the responsible participant;

- if there are complaints about the inspection, the responsible participant has the right to send a written complaint within thirty days from the date of receipt of the report.

If, as a result of the audit, violations or arrears in paying taxes were revealed, responsibility is divided among all participants, except in cases where the payment was not made due to the fault of a participant who provided false information.

The subject of an on-site tax audit of a consolidated group of taxpayers is not always a violation. Sometimes it’s just a planned event, so don’t worry ahead of time.

Liquidation of a consolidated group

There are several reasons why an association may cease to operate. Let's consider the main ones, including:

- expiration or termination of the contract by agreement of all participants;

- recognition by the court of the invalidity of the agreement;

- incorrectly drawn up documents on changes to the contract in connection with the acceptance of a new member of the group or the departure of an old one;

- liquidation or reorganization of the responsible participant;

- bankruptcy of the responsible participant.

If all participants in a consolidated group of taxpayers decide to voluntarily terminate the agreement, then the responsible member of the association must submit a document on termination to the tax authority. Moreover, authorized representatives of all organizations must sign.

In addition, you need to send the original document on the creation of a consolidated group to the tax service. Moreover, this procedure is repeated even if the termination of the association’s activities is based on a court decision or the end of its validity period. After all the necessary documents have been received by the relevant authority, within five days it must notify all tax services where the members of the formation are registered. Officially, the date of termination of the existence of a consolidated group is the 1st of the next tax period.

Summarizing all of the above, it is worth noting that a consolidated group of taxpayers is an association of legal entities pursuing the goal of combining their expenses and income. This is necessary so that the total income tax is significantly less. This way companies save money cash, increasing profits. To join this association, you must meet certain requirements. IN Lately the number of attempts to create a consolidated group of taxpayers has increased several times. Businesses are beginning to realize that by working together, everyone can benefit.

A consolidated group of taxpayers (hereinafter - KGN) is a voluntary association of income tax payers on the basis of an agreement for the purpose of calculating and paying this tax, taking into account the total financial result of their economic activities (clause 1 of Article 25.1 of the Tax Code of the Russian Federation). Calculation and payment of tax (advance payments) is carried out by the responsible participant of the Tax Group (clause 3 of Article 25.1, subclause 2 of clause 3 of Article 25.5, clause 5 of Article 52 of the Tax Code of the Russian Federation).

KGN can be created by Russian organizations, provided that one organization directly or indirectly participates in the authorized capital of other organizations and the share of participation in each such organization is at least 90 percent (clauses 1, 2 of Article 25.2 of the Tax Code of the Russian Federation). According to the explanations of the financial and tax departments, this condition can be confirmed by extracts from the Unified State Register of Legal Entities, copies of constituent documents, extracts from registers of shareholders of a joint-stock company, lists of LLC participants containing the necessary information about the founders (participants) of a legal entity, as well as calculations of the share of direct or indirect participation (Letters from the Ministry of Finance Russia dated 03/02/2012 N 03-03-10/19, dated 12/21/2011 N 03-03-10/120 N AS-4-3/22569@). In Letter dated 02.08.2012 N 03-03-10/87 (clause 1), the Russian Ministry of Finance explained that the Tax Code of the Russian Federation allows for the possibility of creating a consolidated group of taxpayers by organizations in the authorized capital of which a company that is not, in turn, a participant in the consolidated group of taxpayers participates. The CTG is created for at least two tax periods for income tax (Clause 7, Article 25.2 of the Tax Code of the Russian Federation).

Each KGN participant must meet the following requirements:

It should not be in the process of reorganization or liquidation (subclause 1, clause 3, article 25.2 of the Tax Code of the Russian Federation). As the financial and tax departments explained, this condition is confirmed by extracts from the Unified State Register of Legal Entities (Letters of the Ministry of Finance of Russia dated December 21, 2011 N 03-03-10/120, dated December 16, 2011 N 03-03-06/1/831, Federal Tax Service of Russia dated December 29. 2011 N AS-4-3/22569@);

Bankruptcy proceedings should not be initiated against him (subclause 2, clause 3, article 25.2 of the Tax Code of the Russian Federation). The financial and tax departments explained that this condition is confirmed by a certificate drawn up by an organization that is a member of the CGN (Letters of the Ministry of Finance of Russia dated December 21, 2011 N 03-03-10/120, dated December 16, 2011 N 03-03-06/1/831, Federal Tax Service Russia dated December 29, 2011 N AS-4-3/22569@);

The amount of net assets, calculated on the basis of financial statements as of the last reporting date preceding the date of submission of documents to the tax inspectorate for registration of the agreement on the creation (change) of the consolidated group of taxpayers, must exceed the size of the authorized capital (subclause 3, clause 3, article 25.2 of the Tax Code of the Russian Federation). This condition, according to the explanations of the financial and tax departments, is confirmed by the calculation drawn up by the CGN participant on the basis of financial statements in accordance with the provisions and other regulatory legal acts on accounting (Letters of the Ministry of Finance of Russia dated December 21, 2011 N 03-03-10/120, dated December 16 .2011 N 03-03-06/1/831, Federal Tax Service of Russia dated December 29, 2011 N AS-4-3/22569@). Also, the Ministry of Finance of Russia in Letter dated 08/03/2012 N 03-03-06/1/385 explained that failure to comply this condition on the amount of net assets as of other reporting dates does not entail the termination of the CTG.

It should be noted that all documents confirming the organization’s fulfillment of the conditions for creating a consolidated group of taxpayers, with the exception of cases expressly established by law, must be drawn up on the current date, no later than the month preceding the date of their submission to the tax authority (Letters dated December 21, 2011 N 03-03- 10/120, dated December 16, 2011 N 03-03-06/1/831).

A corporate group can be created if all its participants collectively meet the following requirements:

The total amount of VAT, excise taxes, income tax and mineral extraction tax paid during the calendar year preceding the year in which documents are submitted to the inspectorate for registration of the agreement on the creation of the consolidated group of taxpayers is at least 10 billion rubles. Taxes paid in connection with the movement of goods across the customs border of the Customs Union are not taken into account (subclause 1, clause 5, article 25.2 of the Tax Code of the Russian Federation). The Federal Tax Service of Russia, in Letter No. AS-4-3/22569@ dated December 29, 2011, noted that to verify compliance with these requirements, the tax authority can send written requests to the inspectorates at the location of the participants;

The total volume of revenue from the sale of goods (work, services) for the calendar year preceding the year in which documents are submitted to the inspectorate for registration of the agreement on the creation of the consolidated group of companies is at least 100 billion rubles. (Subclause 2, Clause 5, Article 25.2 of the Tax Code of the Russian Federation);

The total value of assets according to the financial statements as of December 31 of the calendar year preceding the year in which documents are submitted to the inspectorate for registration of the agreement on the creation of the consolidated group of groups is at least 300 billion rubles. (Subclause 3, Clause 5, Article 25.2 of the Tax Code of the Russian Federation).

The listed conditions are confirmed by documents certified by the responsible participant of the CTG, including copies of payment orders for the payment of VAT, excise taxes, corporate income tax and mineral extraction tax (copies of decisions of the tax authority on the offset of these taxes), balance sheets, profit and loss statements for the previous calendar year for each of the group members (subclause 3, clause 6, article 25.3 of the Tax Code of the Russian Federation).

Some organizations cannot be members of the group. The corresponding list is established in clause 6 of Art. 25.2 Tax Code of the Russian Federation. In particular, it includes:

SEZ residents;

Organizations applying special tax regimes;

Participants of another group of groups.

At the time of the creation of the group, none of the organizations participating in the group can be in the process of reorganization (Letter of the Federal Tax Service of Russia dated March 20, 2012 N ED-4-3/4638@).

To create a corporate group, participants must enter into an agreement. The requirements for such an agreement are contained in paragraph 2 of Art. 25.3 Tax Code of the Russian Federation. It must contain the following information:

Subject of the agreement;

List and details of organizations - participants of the KGN;

Name of the organization - responsible participant;

List of powers that the participants of the group of groups transfer to the responsible participant;

The procedure and timing for the performance of duties and the exercise of rights by the responsible participant and other members of the group not provided for by the Tax Code of the Russian Federation, liability for failure to fulfill established duties;

The period calculated in calendar years for which the consolidated group of taxation is created, if it is created for a specific period, or an indication that there is no specific period;

Indicators necessary to determine the tax base and pay income tax for each participant of the consolidated group of taxpayers, taking into account the features provided for in Art. 288 Tax Code of the Russian Federation.

The Federal Tax Service of Russia, in Letter No. ED-4-3/22492@ dated December 29, 2011, notes that the agreement on the creation of the CTG should also provide for the following:

The procedure and deadlines for the responsible participant to provide other group members with information necessary for the calculation and payment of income tax, preparation of tax returns upon termination of the Tax Code or the organization’s withdrawal from the group (subclause 4, clause 3, article 25.5 of the Tax Code of the Russian Federation);

The amount of the recourse claim of the CTG participants who paid income tax for the responsible participant, and the procedure for acquiring such a right in the event of failure by the responsible participant to fulfill the obligations to pay profit tax within the CTG (clause 6 of Article 25.5 of the Tax Code of the Russian Federation);

Deadlines for the submission by CTG participants to the responsible participant of tax accounting data necessary for calculating the consolidated tax base (clause 4 of Article 321.2 of the Tax Code of the Russian Federation);

Criteria for the distribution of profit between separate divisions: number of employees (labor costs), residual value of depreciable property (clause 6 of Article 288 of the Tax Code of the Russian Federation).

The tax department warns that failure to comply with these requirements will result in refusal of registration. The Federal Tax Service of Russia also recommends specifying in the agreement the method chosen by the participants for calculating and paying advance payments.